Maximum Section 179 Deduction For 2025

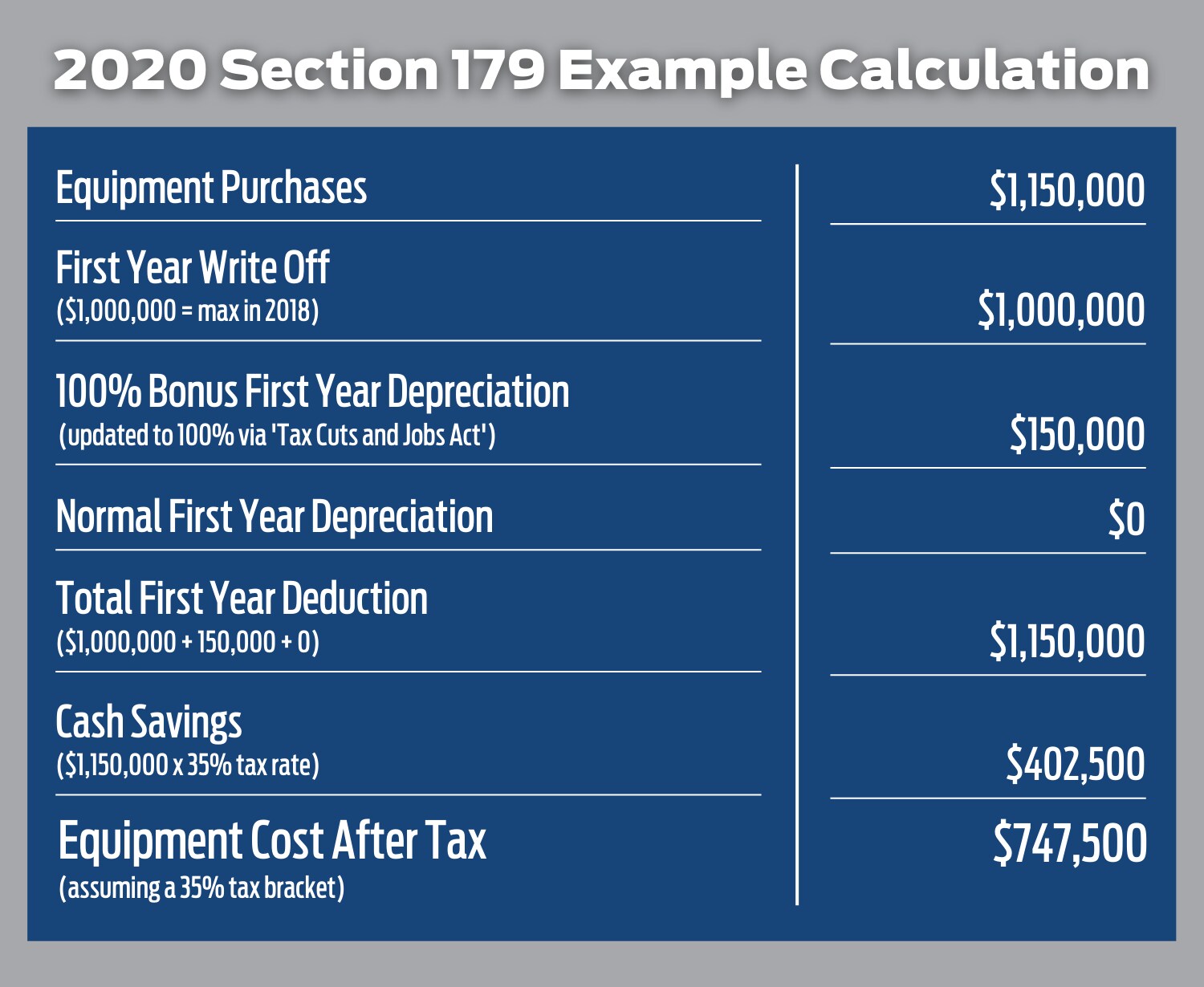

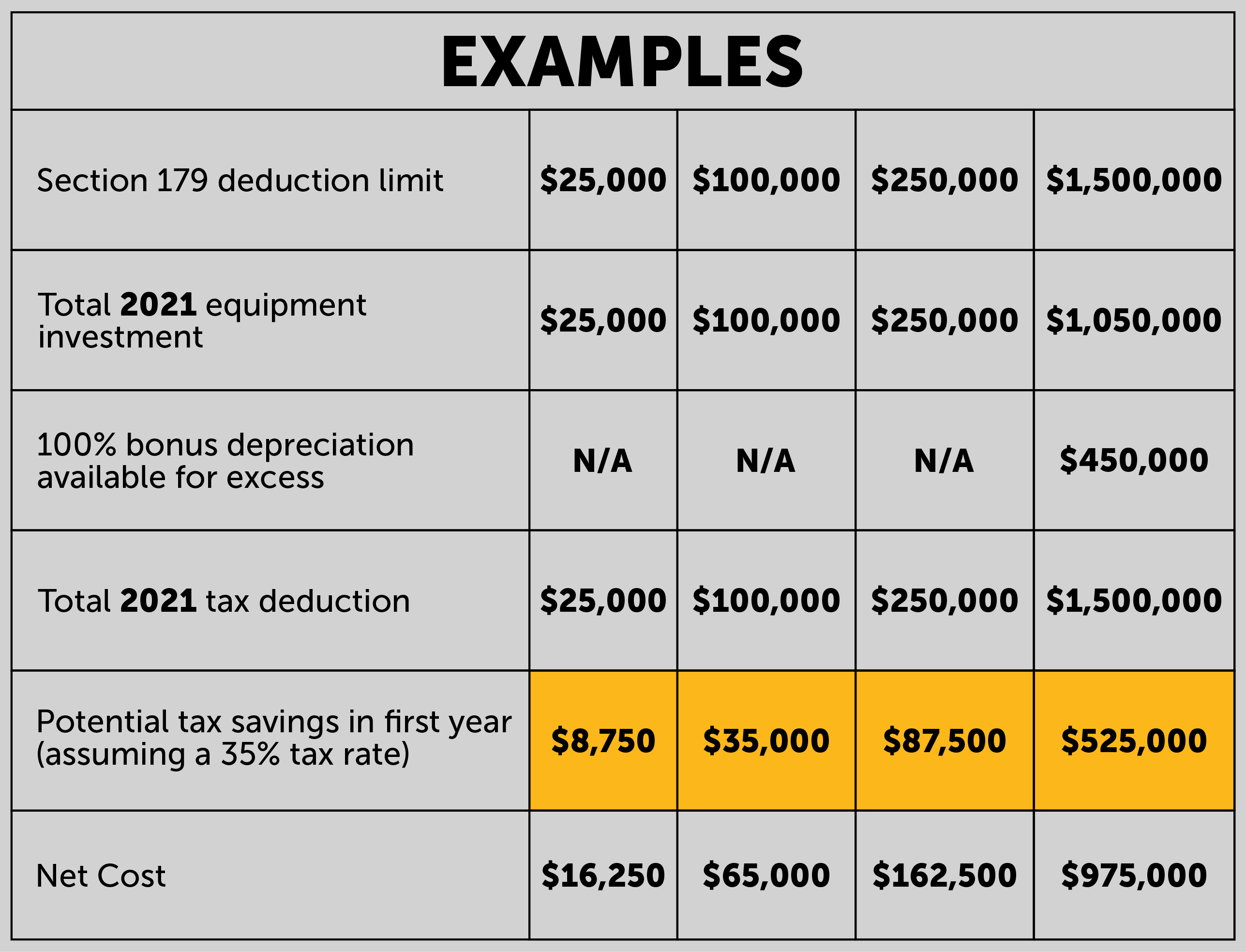

BlogMaximum Section 179 Deduction For 2025. Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax. 179 deduction is $1.22 million.

For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000. However, bonus depreciation can be applied to a percentage of.

Irs Section 179 Bonus Depreciation 2025 Jacob Wilson, Its maximum section 179 deduction is $1,110,000.

Irs Section 179 Bonus Depreciation 2025 Jacob Wilson, For the 2025 tax year, the maximum deduction limit is $1,160,000.

179 Deduction 2025 Alexi Austina, However, for 2025 (with taxes filed in 2025), the highest section 179 deduction is set at $1,220,000, reflecting a $60,000 increase compared to.

Section 179 Deduction for Business Equipment How it Works, Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax.

Section 179 Deduction Vehicle List 2025 Melli Siouxie, For tax years beginning in 2025, the maximum section 179 expense deduction is $1,220,000.

Section 179 Deduction Vehicle List 2025 Irs Lory Silvia, The maximum section 179 deduction is $1,220,000 for 2025 ($1,160,000 for 2025).

Section 179 Tax Deduction for 2025, It begins to be phased out if 2025 qualified asset additions exceed $3.05.

2025 Section 179 Limits Ardys Winnah, In 2025, beech partnership placed in service section 179 property with a total cost of $2,940,000.

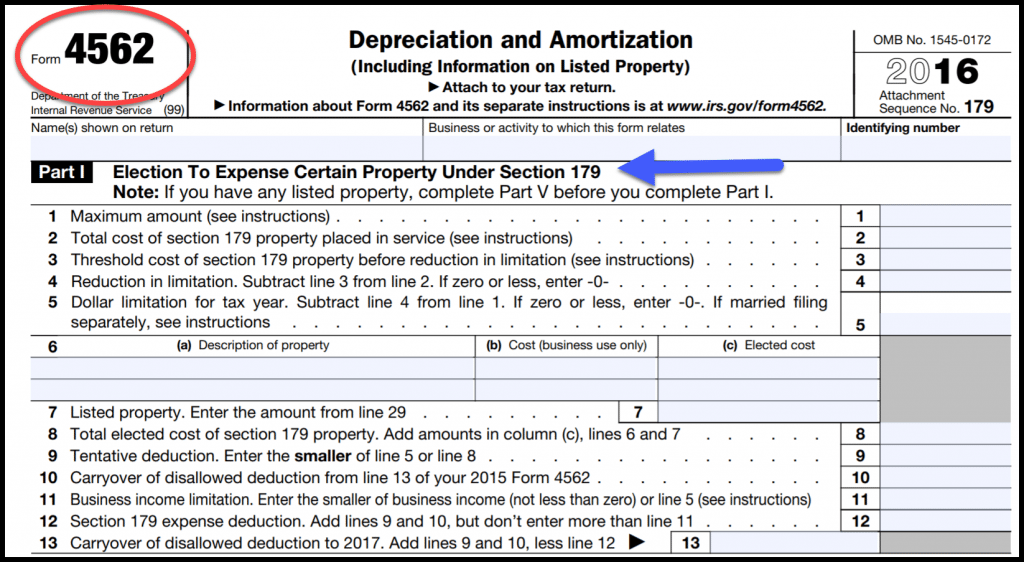

Understanding Section 179 Deduction for Restroom Trailers, Business taxpayers complete irs form 4562 and select the section 179 deduction when filing.